Join day by day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

T&E analyses the methods that producers are anticipated to make use of to conform.

Abstract

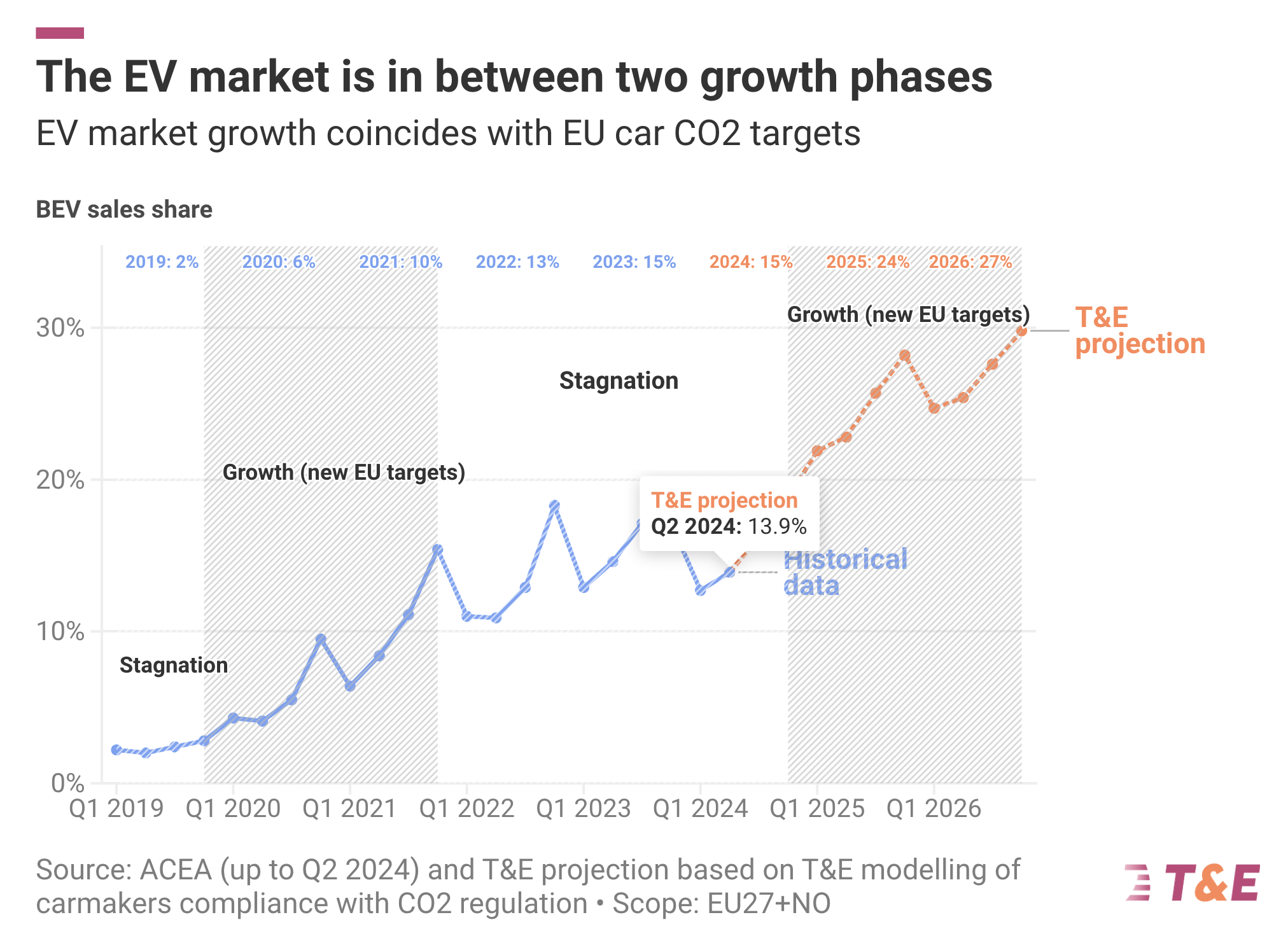

The EU’s 2025 Automotive CO2 goal is reachable and possible

After years of stagnant EV gross sales because of the lack of recent automotive CO₂ targets, carmakers will face stricter requirements in 2025, following the final targets set in 2021. Whereas some carmakers have been calling to weaken the regulation, T&E exhibits that each one carmakers can meet their 2025 targets. T&E breaks down the methods carmakers are anticipated to make use of to conform primarily based on modelling of compliance situations counting on: gross sales information, carmakers’ public plans, and evaluation of information from market analysis firm GlobalData. The compliance choices embrace growing gross sales of full electrical automobiles (BEVs), gentle and full hybrids (HEVs) and plug-in hybrids (PHEVs), in addition to numerous compliance flexibilities. This evaluation offers an perception into carmakers’ paths to adjust to the goal in 2025.

As with previous automotive CO₂ targets, carmakers are anticipated to shut their compliance hole within the goal 12 months, fairly than forward of time. Between 2019 and 2020, carmakers furthest away from their targets improved their CO₂ efficiency by 20 gCO₂/km. Within the first half of 2024, most carmakers are near assembly their goal with gaps starting from 10-17 gCO₂/km. Leaders in EV gross sales equivalent to Volvo Vehicles have already reached their 2025 goal. Volkswagen (VW) and Ford are the furthest behind with gaps of 28-29 gCO₂/km and should contemplate forming compliance swimming pools with leaders to cut back the hole. As an illustration, if VW swimming pools with Tesla, it will solely want to realize a 17% BEV share in 2025 (down from 22%). Equally, if Ford swimming pools with Volvo once more, BEVs would wish to account for simply 9% of its gross sales, as a substitute of 21%.

It’s essential to emphasize that the 2025 goal is not an electrical automotive mandate, and — technically — no necessary EV gross sales share is critical. The goal, proposed again in 2017 and unchanged since then, is a CO₂ common: promoting extra environment friendly petrol automobiles (or fewer SUVs) helps as a lot as promoting electrics. As well as, quite a few flexibilities are allowed: an extra bonus for >25% ZLEV gross sales, eco improvements, in addition to pooling emissions with different producers, e.g. pure EV gamers.

In 2025, carmakers are anticipated to spice up EV gross sales in 2025. In T&E’s central compliance state of affairs, EV gross sales are anticipated to rise to 24% market share in 2025 (from 14% within the first half of 2024), supported by an enlargement of mass market EV choices, together with seven inexpensive (

Whereas BEVs play the most important function, carmakers additionally depend on different compliance choices. In T&E’s compliance state of affairs, on common, 20% of the CO₂ discount could be achieved by promoting extra hybrids, whereas regulatory flexibilities would contribute to a 12% CO₂ discount, and PHEVs may present 8% of the enhancements. Stellantis (33%) and VW (30%) would rely essentially the most on HEV gross sales to satisfy their targets. In consequence, regardless of not being a future proof choice, the share of gentle hybrids is predicted to double (from 19% to 37%). BMW is predicted to rely most on PHEVs (18%).

The automotive CO₂ regulation has confirmed efficient and can proceed to push carmakers in the direction of electrification however must be accompanied by nationwide EV insurance policies: charging masterplans and steady, focused subsidy schemes. To make sure Europe’s automotive business stays aggressive and leads within the mass-market EV sector, policymakers should resist calls to weaken the 2025-2035 targets or delay compliance. The present lead loved by Chinese language EV makers solely exhibits that the longer the EU protects its laggard automakers, the much less aggressive they are going to be.

Half 1

Stagnation and development: how the European EV market works

The BEV share of the European automotive market decreased barely to 13.3% within the first half of 2024, in comparison with 13.8% within the first half of 2023 and 15.4% for the entire of 2023.

Stagnation section: The gradual development of BEVs within the 2022-2024 interval is because of the CO₂ requirements design and carmakers revenue pushed technique. This stagnation has been anticipated by T&E and market analysts since 2020.

-

The EU automotive CO₂ regulation is designed with 5-year steps with new targets in 2025 and 2030. Previous proof exhibits that carmakers don’t adjust to automotive CO₂ targets prematurely, however solely when the targets require it. Earlier T&E evaluation confirmed carmakers had been solely half-way to the 2020 goal 4 months earlier than the beginning of 2020.

-

Carmakers give attention to ICE earnings forward of the following development section pushed by 2025 targets. Within the stagnation section, carmakers prioritise short-term earnings via the sale of high-margin automobiles (e.g. Volkswagen’s “value over volume” technique). Earlier T&E evaluation has proven that carmakers’ disproportionate give attention to bigger, extra premium fashions has resulted in excessive costs for EVs in Europe which has slowed down EV gross sales consequently.

Progress section: Carmakers are anticipated to ramp up mass-market inexpensive EVs to satisfy 2025 targets

Within the subsequent development section from 2025 onwards, electrical automotive gross sales would decide up as carmakers have to prioritise EV gross sales to satisfy the following automotive CO₂ goal. As introduced in part 4, T&E expects EV gross sales to develop to twenty%-24% in 2025, partly because of inexpensive fashions coming to the market (see part 3). This stop-and-go technique creates a succession of stagnation and development phases.

Nonetheless, as carmakers prioritise their earnings and shareholder payouts, many OEMs are calling on the European Fee to weaken the automotive CO₂ regulation even if the targets have first been proposed again in 2017. As an illustration, ACEA’s president Luca De Meo is looking for “a little more flexibility” within the regulation implementation whereas Volkswagen needs the EU to melt CO₂ emissions targets. This briefing seems to be forward to 2025, analysing carmakers’ compliance hole primarily based on gross sales within the first half of 2024 and describing how all carmakers can adapt their gross sales to satisfy the targets (methodology described in annex 6.1 of downloadable pdf briefing).

Half 2

Carmakers’ progress in the direction of 2025 CO₂ targets is uneven

Whereas Volvo Vehicles is already on observe to satisfy its 2025 goal primarily based on gross sales within the first half of 2024, Volkswagen and Ford are furthest away. Different carmakers are within the center and anticipated to satisfy their targets. This general compliance image with one chief, two laggards and different carmakers with a reasonable hole round 10 gCO₂/km has not modified a lot since 2023. Nonetheless, given there’s been a BEV slowdown since 2023, the compliance hole has barely elevated for many carmakers over the primary half of 2024 (in comparison with the total 12 months 2023). This example isn’t new as most carmakers had related gaps with their 2020 goal in 2019.

The BEV slow-down within the first half of 2024 led common CO₂ emissions to extend to 109 gCO₂/km from 107 gCO₂/km in 2023. Volvo Vehicles is the one legacy carmaker that’s already compliant (over-compliance of 31 gCO₂/km). Among the many non-compliant carmakers, Kia is the closest to the 2025 goal with a niche of 10 gCO₂/km. Many of the carmakers’ targets are effectively inside attain with gaps starting from 10 and 17 gCO₂/km.

To shut the hole by 2025, Ford and Volkswagen might want to redouble their efforts.

Ford and Volkswagen are the furthest away from their targets with gaps of 28 and 29 gCO₂/km respectively. Whereas these two carmakers might want to double down on their efforts in 2025 to shut the hole, they’ve many attainable compliance methods as highlighted in part 4.

Again in 2019, carmakers additionally had giant gaps with their 2020 targets.

Trying on the market common, the compliance hole is 15 gCO₂/km in H1 2024, the same worth because the 13 gCO₂/km hole in 2019 in comparison with the 2020 goal. BEV gross sales are anticipated to normalise within the second a part of 2024 because the market recovers from the abrupt elimination of the subsidy in Germany (e.g. by decreasing EV costs as VW has already finished). The complete 12 months 2024 hole could be decrease than the present 15 gCO₂/km and will even turn out to be decrease than 2019. Hyundai was the foremost carmaker that was the furthest away from its 2020 goal in 2019 with a niche of 17 gCO₂/km. Regardless of this hole, it nonetheless over-complied in 2020, bettering its CO₂ efficiency by 20 gCO₂/km. Ford and Volkswagen at the moment have considerably larger gaps than in 2019 (Ford ultimately fashioned a pool with Volvo Vehicles and VW with MG) whereas Kia and Mercedes-Benz are at the moment doing higher than 5 years in the past.

Learn Half 3 of the report, “Carmakers strategies to comply with their CO₂ targets in 2025,” Half 4, “EV sales to grow as carmakers focus on compliance,” and extra within the full report right here.