Join each day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

In the USA, electrical energy consumption is rising quickest in Texas, the place the Electrical Reliability Council of Texas (ERCOT) manages 90% of the load on the state’s energy grid. One of many primary sources of rising demand for energy is large-scale computing services equivalent to knowledge facilities and cryptocurrency mining operations, though their future calls for are unsure. In our newest Quick-Time period Vitality Outlook (STEO), we count on electrical energy demand from clients recognized by ERCOT as massive versatile load (LFL) will complete 54 billion kilowatt-hours (kWh) in 2025, up nearly 60% from anticipated demand in 2024. This anticipated demand from LFL clients would signify about 10% of complete forecast electrical energy consumption on the ERCOT grid subsequent yr.

These services devour massive quantities of electrical energy, each to run their computing tools and to maintain them cool. Among the bigger services can devour as a lot electrical energy as a medium-sized energy plant. In mid-2022, ERCOT developed a program for approving proposed LFL clients (these with an anticipated peak demand capability of 75 megawatts [MW] or better) to make sure grid reliability. The LFL Job Power publishes periodic standing updates that point out how a lot capability has been permitted and is anticipated in upcoming years.

Sure large-load services, primarily cryptocurrency mining services but in addition knowledge facilities and a few industrial factories, have entered into voluntary curtailment agreements with ERCOT to briefly scale back their energy consumption during times of notably excessive system demand or low generator availability. As a part of this system, LFL services can take part in ERCOT’s power and ancillary service markets. This flexibility in large-load operations may help mitigate among the results that robust progress in electrical energy demand is having on the ERCOT system.

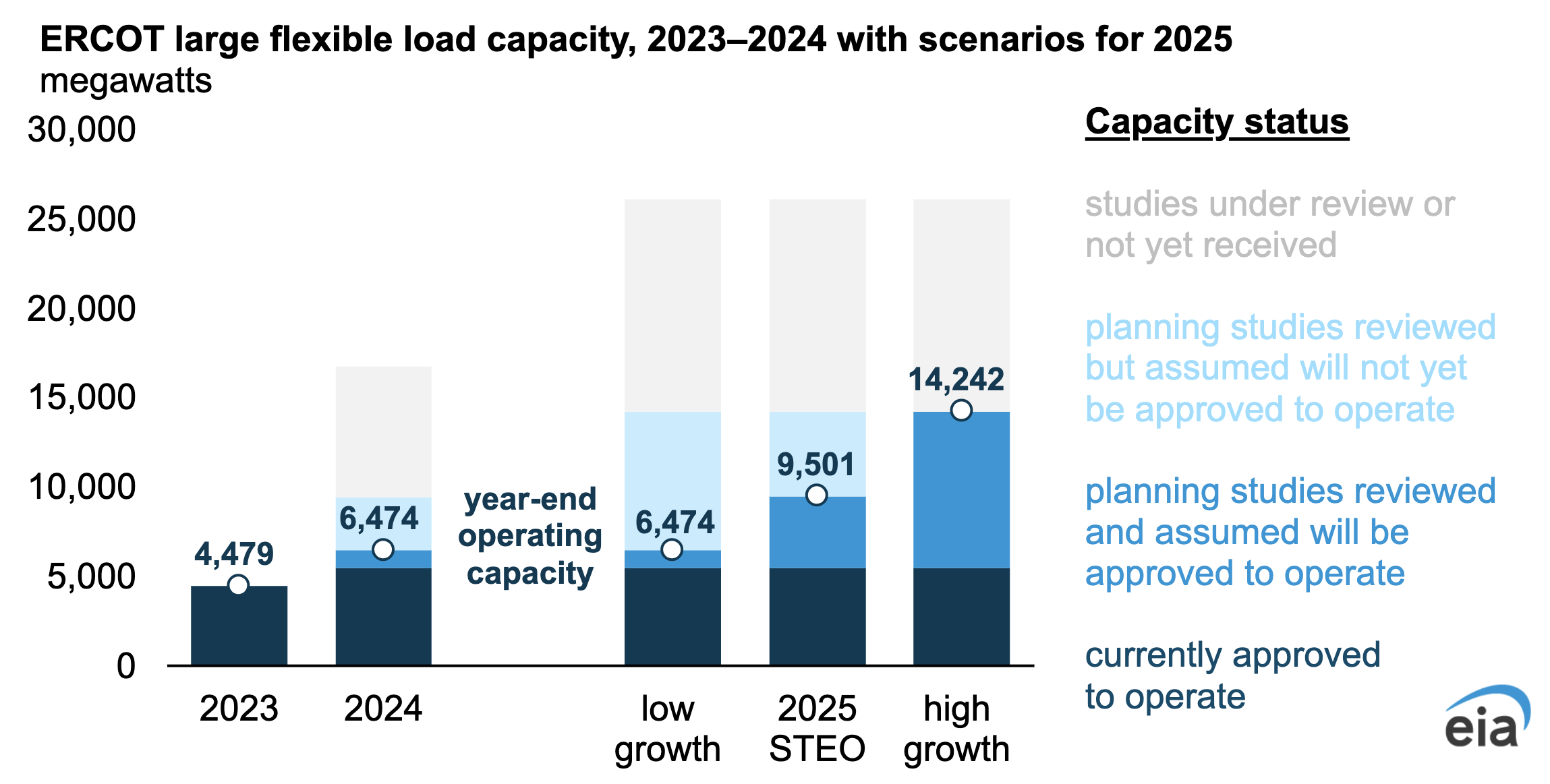

We use the knowledge from ERCOT about present and future LFL demand in creating our STEO forecasts of regional electrical load. We assume that by the tip of 2025 ERCOT can have permitted operations of 9,500 MW of LFL demand capability, which might be 73% greater than is presently permitted (5,479 MW of which 1,570 MW was permitted over the previous 12 months).

Traditionally, LFL clients have consumed about 65% of their complete permitted capability. Within the STEO, we assume that LFL demand is fixed all through the day at this proportion, so the anticipated 2025 capability and its utilization translate to an assumed complete LFL of 54 billion kWh subsequent yr. This new electrical energy consumption from massive computing and industrial services contributes to our forecast that ERCOT’s load throughout all clients will develop by 5% between 2024 and 2025.

Uncertainty about future ranges of large-load demand

Though a lot deliberate capability for large-load clients is awaiting approval from ERCOT, when or if the capability will probably be introduced on-line stays unsure. ERCOT’s standing replace from early September signifies that initiatives representing about 26,500 MW of LFL capability have utilized to develop into operational by the tip of 2025. This quantity contains about 2,000 MW of capability for initiatives that haven’t but submitted plans and greater than 12,000 MW of capability for initiatives that presently have plans below assessment by ERCOT. Given the standard approval timeline, these initiatives are unlikely to return on-line by the tip of subsequent yr.

To research the potential results of various ranges of future large-load electrical energy demand on energy era and wholesale costs in ERCOT, we modeled two situations with completely different assumptions about 2025 LFL capability and in contrast the outcomes with the September STEO forecast as a base case. In all three circumstances, we assume that LFL services will probably be demand-responsive, chopping again a part of their electrical energy consumption throughout hours when potential wholesale energy costs exceed $100 per megawatthour (MWh). The precise degree of curtailment noticed may differ vastly from these assumptions relying on whether or not the large-load buyer believes the incentives are worthwhile.

Delays within the large-load approval course of or in builders’ plans may scale back new large-load energy demand subsequent yr. In our low-growth situation, we assume that no extra LFL capability comes on-line subsequent yr past what we count on to be operational on the finish of 2024 (6,500 MW). This assumption would translate into about 37 billion kWh of LFL electrical energy consumption in 2025 (32% decrease than the baseline forecast of 54 billion kWh).

Conversely, it’s potential that ERCOT may rapidly start approving initiatives within the LFL queue at a quicker tempo. Our high-growth situation assumes that about 14,200 MW of LFL capability will probably be operational by the tip of subsequent yr, resulting in a forecasted 81 billion kWh of electrical energy consumption from LFL clients in 2025 (50% greater than the baseline STEO assumption).

In our baseline September STEO, we forecast that ERCOT’s electrical energy load throughout all varieties of clients will develop by 5% from 464 billion kWh in 2024 to 487 billion kWh in 2025. In distinction, in our low-growth situation, general ERCOT load would develop by only one% subsequent yr, and in our high-growth situation, ERCOT load would develop by 10%. For each the low- and high-growth situations, we assume all different elements (equivalent to generator gas prices and non-LFL) stay the identical as within the baseline forecast.

How rising demand from massive versatile load sources may have an effect on energy era

The most important supply of electrical energy era in ERCOT is pure gasoline, accounting for 45% of that area’s era in 2023. We assume that present and deliberate producing capability is similar throughout the three situations, and our completely different assumptions about future electrical energy demand have essentially the most impact on pure gasoline era. In actuality, the electrical energy sector may reply to the anticipated degree of future demand by increasing the capability out there from different sources of era.

In our September STEO, we forecast that annual pure gas-fired era in ERCOT will fall by 5% between 2024 and 2025 to an annual complete of 198 billion kWh in response to elevated era from renewable power sources, notably photo voltaic. Our situation with stronger progress in large-load demand ends in 8% extra pure gas-fired era in 2025 than the baseline forecast, at 213 billion kWh. Our low-growth situation forecasts 12% much less pure gas-fired era than the baseline.

The fastest-growing supply of latest electrical producing capability in the USA is solar energy, with progress concentrated in Texas. Our base case STEO forecasts that photo voltaic era in ERCOT by the electrical energy sector will develop by 54% in 2025 to 67 billion kWh. Solar energy is usually dispatched as era at any time when it’s out there as a result of it doesn’t have working prices like fossil-fuel mills. It can be curtailed to keep away from grid congestion or if electrical energy demand is low at a specific time. In 2023, about 3% of photo voltaic output in ERCOT was curtailed. In our high-growth situation, we forecast 2% extra photo voltaic era than within the base case in 2025 as a result of much less output would must be curtailed.

The opposite main supply of energy era that would change below completely different assumptions about electrical energy demand tendencies can be coal, which accounted for 14% of ERCOT era in 2023. Like pure gasoline, coal has extra versatile era patterns than renewables, and so modifications in demand usually tend to elevate or decrease coal-fired era. In our low-growth situation, we forecast 5% much less ERCOT coal-fired era in 2025 than the STEO base case forecast of 62 billion kWh and 12% extra within the high-growth situation.

Affect of unsure large-load demand on wholesale energy costs

The impact of unsure future electrical energy consumption is most evident in wholesale energy costs, which mirror how properly producing provide can meet electrical energy demand. As a consultant wholesale value for ERCOT, the STEO makes use of common settlement level costs (SPP) throughout peak hours on the North zone hub, which incorporates the Dallas-Fort Price metropolitan space. The bottom case STEO forecasts ERCOT wholesale energy costs in 2025 will common about $27/MWh, which might be 22% decrease than our anticipated wholesale value for 2024. Decrease costs are a results of anticipated decrease fuels prices for pure gasoline together with elevated penetration of photo voltaic era.

The situation with less-than-expected progress in large-load demand reduces forecasted 2025 wholesale energy by 11% from the bottom case STEO forecast, whereas the high-growth situation will increase costs by 17% from the bottom case. In each situations the biggest variations from the bottom case situation happen in the summertime months. LFL demand was curtailed solely throughout 10 hours of the high-growth and base case situations, averaging 23% of LFL within the high-growth situation and 13% of LFL within the base case throughout these hours.

ERCOT arrange its LFL program for large-load clients to assist handle the influence of probably robust progress in demand. By requiring approval of the initiatives and inspiring curtailment of demand when wanted, the LFL course of intends to reduce the chance of wholesale energy costs spiking to ranges of $1,000/MWh or extra. Texas is pursuing different avenues to accommodate the anticipated improve in energy demand from massive computing services such because the Texas Vitality Fund, which is designed to encourage growth of latest dispatchable producing capability.

Principal contributor: Tyler Hodge. First revealed on Right this moment in Vitality.