Join every day information updates from CleanTechnica on electronic mail. Or observe us on Google Information!

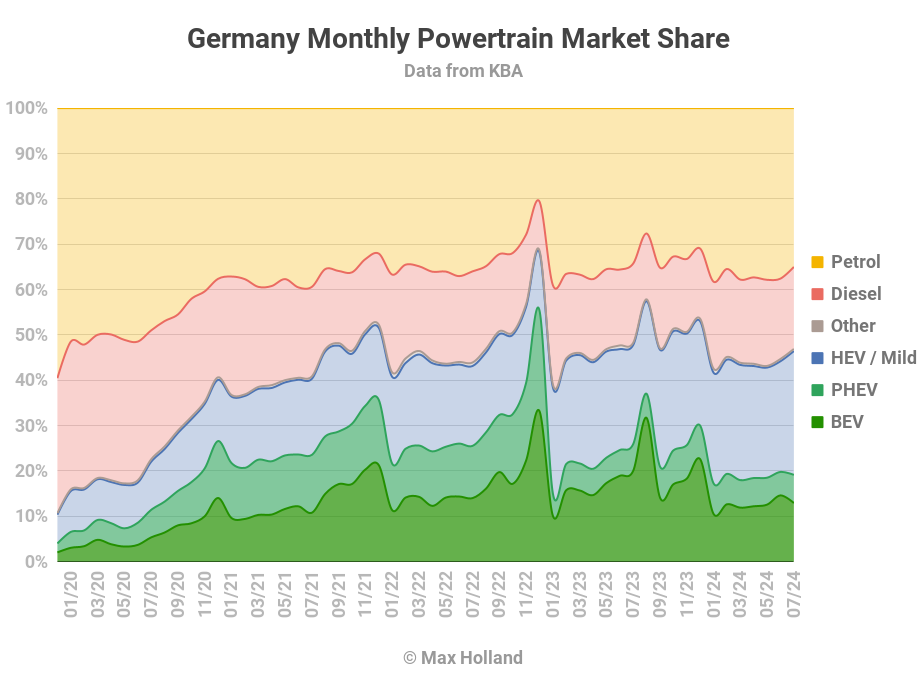

July noticed plugin EVs at 19.1% share in Germany, down from 25.9% 12 months on 12 months. BEV share has even dipped under the place it was 2 years in the past, and PHEV share has additionally fallen since then. July’s total auto quantity was 238,263 models, down 2% YoY, and down round 23% from 2017–2019 seasonal norms (~310,000 models). The perfect promoting BEV in July was the Tesla Mannequin Y.

July’s auto gross sales figures noticed mixed EVs at 19.1% share in Germany, with full electrics (BEVs) at 12.9% and plugin hybrids (PHEVs) at 6.2% share. These evaluate with YoY figures of 25.9% mixed, 20.0% BEV and 5.9% PHEV.

The drop in YoY BEV share is actually a poor displaying, but the magnitude is amplified additional by a excessive baseline. The baseline of July 2023 was experiencing a BEV pull-forward forward of the upcoming reducing of incentives for business patrons (companies and fleets, and so on.) on the finish of August, so noticed the next share than regular. Even with out that pull ahead, the July 2023 baseline BEV share would probably have been within the 15% to 17% vary. Nevertheless, that’s nonetheless embarrassingly far forward of the present BEV share of 12.9%. As famous within the intro, even July 2022 had larger BEV share, 14.0%!

The woeful backsliding in Germany’s BEV market share is a mix of a number of key elements. The latest proximate issue stays the abrupt unscheduled reduce of BEV buy incentives in December 2023, which was a really public shock to the market and has made BEVs successfully costlier from the angle of the top client. This sudden change was so poorly dealt with by Germany’s politicians that it turned extremely seen and thus broadly recognized about — each new automobile purchaser is conscious that BEVs at the moment are successfully “more expensive” than just a few months in the past, because of the subsidy removing.

This short-term trauma is mixed with the extra basic incontrovertible fact that, over the previous couple of years, lots of Europe’s legacy automakers have total elevated the listing costs of their entry BEVs, as a substitute of lowering them, while these identical auto manufacturers have paid out report earnings to administration and shareholders. A number of impartial studies have documented this improve within the value of Europe’s legacy model BEVs. These embrace studies by JATO Dynamics and briefing papers by Transport & Surroundings.

Unsurprisingly, then, large European legacy marques like Volkswagen, Stellantis, and Renault have truly decreased their BEV gross sales from Q1 2023 to Q1 2024 throughout 15 key European markets, together with Germany, Europe’s greatest auto market.

The BEV value will increase from legacy automakers successfully imply that — as a substitute of steadily turning into extra inexpensive to shoppers (as new applied sciences virtually at all times do) — BEVs at the moment are far overpriced in Europe in comparison with ICE alternate options. That is in sharp distinction to the rising affordability of BEVs in most different components of the world — for instance, Latin America, Australia, and particularly China, the place BEV adoption is rising very quick. In China, BEVs at the moment are at value parity with ICE autos throughout most key segments, and in consequence, plugins at the moment are at 50% of the auto market.

The dearth of inexpensive BEV choices in Europe (regardless of battery and different BEV powertrain prices being at report lows) is essentially as a result of most legacy European auto corporations are decided to do the authorized minimal to modify over to BEVs, and wish to maintain promoting ICE vehicles for so long as they will.

In Germany’s case, the development of overpriced BEVs combines with a really weak nationwide financial system. Each quarter over the previous 12 months has proven constantly unfavourable financial output. Clearly objects perceived as comparatively costly grow to be much less engaging throughout a recession, particularly when rates of interest (on financed objects) are additionally excessive.

This mix of things, significantly the cynical BEV pricing in Europe, is the reason for the declining BEV share in Germany’s auto market.

In the meantime, gross sales of plugless autos in Germany have elevated year-to-date in comparison with 2023, as has their market share. These embrace hybrids, but additionally combustion-only autos. Yr up to now, petrol-only autos are up in quantity over 6.5% in comparison with 2023, with elevated market share. Diesel-only are up in gross sales quantity by much more — 8.9%!

Greatest Promoting BEV Fashions

The Tesla Mannequin Y was again to the highest of the charts in July, with 1,926 models registered. June’s chief, the Volkswagen ID.3, slid all the way down to thirteenth spot.

In Second place was the Skoda Enyaq, with 1,718 models, up from 4th in June. Third place went to the Cupra Born, with 1,683 models, up from sixth in June.

Seeing first rate climbs in comparison with June had been the Fiat 500e, the BMW iX1, the Volkswagen ID.7, and the BMW i5. Simply outdoors the highest 20, the brand new Audi Q6 e-tron climbed to twenty first place (with 473 models), up from 68th in June (69 models).

Maybe not coincidentally, the Audi Q8 e-tron slipped from twenty third in June to twenty eighth in July. The older Q8 now seems to be like poor worth in comparison with the brand new Q6 e-tron (primarily based on the brand new PPE platform and providing a greater ratio of inside area to total size). Audi will presumably should essentially replace the Q8 (maybe additionally using the PPE platform) to ensure that it to stay related.

There have been 4 all new BEV debutants in July. The Polestar 4, and the Polestar 3 each noticed their first deliveries, with 88 and 70 models, respectively.

The Polestar 4 is a big CUV format automobile with a coupe silhouette, with size of 4,839 mm, ranging from €61,900 in Germany, for 94 kWh of battery (usable) and ~30 minute DC charging (to 80%). Rated vary is 620 km (WLTP).

The Polestar 3 is a barely longer (4,900 mm) and heavier automobile, in a extra traditional boxy SUV form. It has a bigger 107 kWh (usable) battery with a 650 km rated vary (WLTP) and comparable charging velocity. It’s costlier, with German pricing from €78,590 and up. Let’s see how these new Polestar fashions get on within the German market.

Subsequent up is the brand new Ford Explorer (16 preliminary models), which is mainly Ford borrowing the MEB platform from Volkswagen Group, and styling their very own model of the Volkswagen ID.4. The Ford restyle has a barely extra conventional boxy form, as a substitute of the ID.4’s extra apparent curves.

At launch, the Ford Explorer is out there solely within the 77 kWh (usable) battery, priced from €49,500, although the smaller 52 kWh variant is deliberate for later. These battery sizes, the output energy, and different technical specs are largely precisely the identical as its Volkswagen ID.4 second cousin, unsurprisingly. For some purpose, nevertheless, Ford quotes a WLTP vary of 602 km, greater than the 550 km of the ID.4 (with the identical battery). The inside styling, nevertheless, is extra distinct from the ID.4. And but – in a stunning determination – the Ford nonetheless inherits the ID.4’s annoying haptic buttons!

The ultimate debutant of the month was a low-volume sports activities sedan from Lotus, the Emeya (9 preliminary models). Priced from over €100,000 this isn’t going to maneuver the needle on the BEV transition, nevertheless it’s nonetheless good to see but extra of the excessive finish of the market switching over to BEV.

Relating to final month’s obvious debutant, the Audi A6 e-tron, there have been one other 8 models registered in July, however these are virtually actually just for showrooms. Official buyer orders solely open in early September, and there’s nonetheless no pricing data.

Let’s now flip to the longer perspective:

Regardless of weak numbers in July, the Volkswagen ID.3 stays on high of the 3-month rating, forward of the MG4, and Tesla Mannequin Y. This can be a large climb for the MG4 over the prior interval (eleventh), primarily because of Might and June volumes (probably a pull ahead forward of the upper EU tariffs from early July).

Fashions climbing the rating since 3 months prior embrace the Fiat 500e (up 13 spots), the Volkswagen ID.7 (up 16 spots), and the refreshed Mini Cooper (additionally up 16 spots). Much less dramatically, however maybe extra considerably, the Volvo EX30 has continued to climb, now as much as ninth place.

Let’s rapidly verify in with the manufacturing group rankings:

Volkswagen Group has elevated its share of the German BEV market to 34.8%, from 29.4% three months prior. It overshadows all the others.

BMW Group has elevated its share and jumped up from 4th to 2nd, overtaking Mercedes and Tesla, which each step again one place in consequence. SAIC, because of the pre-tariff push, has climbed from eighth to fifth, however will step again once more within the coming months.

Toyota Group and Honda stay dragging their ft in the back of the pack, every with 0.3% of the BEV market, an excellent worse efficiency than 3 months prior.

Outlook

The two% YoY shrinkage in auto gross sales in July correlates with a wider German financial system which is in recession. Each quarter over the previous 12 months has seen YoY unfavourable GDP progress, with 2024 Q1 and Q2 each displaying unfavourable 0.1% outcomes.

Inflation was at 2.3% in July, not a lot modified since February. Rates of interest fell to 4.25% in early June, and have remained there since. Manufacturing PMI improved barely to 43.2 factors in July, from 42.6 factors in June.

As mentioned within the Sweden report, legacy auto producers in Europe aren’t serious about dashing the transition to BEVs, they’re merely doing the minimal legally required by the emission rules (while as a substitute making report earnings).

Sadly these rules don’t require extra progress in 2024 in comparison with latest years, so the producers aren’t attempting (or attempting not) to extend their BEV gross sales. The foundations will tighten considerably in 2025, so Europe’s transition is on pause till then.

What are your ideas on Germany’s auto market and up to date (backward) development within the EV transition? Please bounce into the dialogue under and tell us.