Join every day information updates from CleanTechnica on electronic mail. Or comply with us on Google Information!

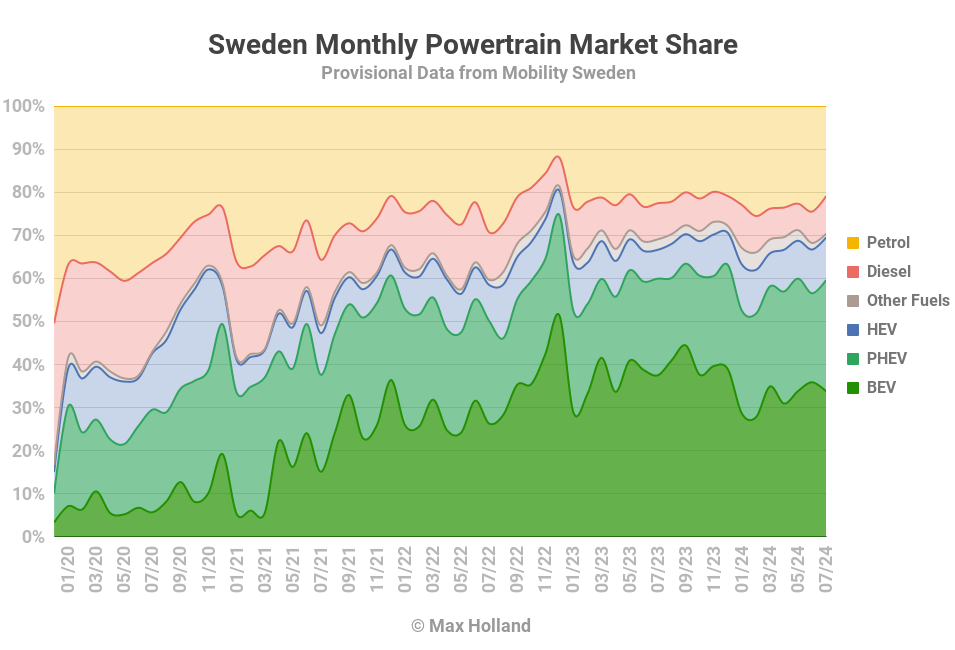

July’s auto gross sales noticed plugin EVs at 59.6% share in Sweden, virtually flat YoY from 59.9%. BEV volumes had been down YoY by 15%, whereas PHEVs grew by 9%. General auto quantity was 16,337 models, down 6% YoY. The Tesla Mannequin Y remained the perfect promoting BEV.

The July market knowledge confirmed mixed plugin EVs at 59.6% share in Sweden, with full electrical BEVs at 33.8% and plugin hybrids (PHEVs) at 25.8%. These figures evaluate YoY in opposition to 59.9% mixed, 37.5% BEV and 22.4% PHEV.

Sweden’s progress within the EV transition continues to go backwards, with BEV share once more decrease in July than a 12 months in the past. 12 months thus far, cumulative BEV share now stands at 32.5% in comparison with 37.3% at this level a 12 months in the past. PHEVs have grown YoY to take up a few of the slack, however not sufficient to outweigh the drop in BEV gross sales.

Why is that this taking place? There’s one main cause, and two minor influences. The minor ones embrace the weak financial system and the curtailment of BEV buy incentives (in comparison with nonetheless being considerably current a 12 months in the past). The key cause is the continued over-pricing of BEVs and an absence of reasonably priced BEVs from legacy European automakers.

As of June, this overpricing of legacy model BEVs is now mixed with the added headwind of the world’s finest worth BEVs (these made in China) being made 20% to 38% costlier by protectionist tariffs by EU politicians (learn: safety of legacy auto’s outlandish margins and file earnings paid out to shareholders and in government salaries).

For an in depth report on how legacy auto elevated its BEV costs and made file earnings over the previous two years, see this current briefing by Transport & Setting (obtain the complete PDF from there).

In China, the world’s best client market, BEVs at the moment are competing with ICE autos on sticker value, and are successful. Jose’s newest China market report reveals regular regular development in market share continues, with the highest BEV and PHEV fashions now outselling ICE fashions in most car segments. EVs at the moment are in a position to compete with ICE on value as a result of prices of BEV powertrains have steadily diminished (as the price of any new expertise does over time) and sticker costs will not be being over-inflated by profit-seeking legacy auto. There’s an excessive amount of competitors, and customers received’t stand for it.

This isn’t the case in Europe. To repeat a transparent instance, in Sweden, the Peugeot e-208 from Stellantis has an MSRP over twice that of the ICE model (SEK 489,900 vs. 239,900). This overpricing by legacy auto is deliberate, it could properly point out collusion (aka value fixing), and it’s clearly blocking the progress of the EV transition.

Nice, you would possibly say, they will play their video games — simply let outdoors manufacturers are available in and compete; that may present them, proper? Properly, no. The really reasonably priced BEVs from outdoors manufacturers “must” be subjected to extra tariffs (in any other case they’d erode the surplus margins and extra earnings of legacy European auto) — such that customers can’t simply buy them both.

Why don’t legacy auto firms need to produce extra BEVs? As a result of they need to squeeze as a lot revenue as attainable out of their decades-old ICE applied sciences and investments (rent-seeking).

Let’s be trustworthy — they’ve solely ever carried out the minimal legally attainable on the EV entrance. The expansion in 2020 and 2021 in Europe was because of laws, not from their real want to transition to EVs. In the meantime, most European governments and/or the EU — that are in thrall to those identical sorts of powers-that-be companies (neo-liberal company capitalism, or “profits over people”) — have paused any tightening of emissions necessities till 2025. There may be subsequently no regulatory “stick” motivating legacy auto to extend BEV gross sales till then. In the meantime, the EU tariffs on outdoors EVs guarantee there’s minimal aggressive stick, too.

Thus, throughout the pattern of 15 European markets coated by the EU-EVs database, Europe’s highest quantity automotive model, Volkswagen, offered 41,532 BEVs within the first quarter of 2023 however had diminished gross sales all the way down to 24,749 in Q1 2024. The identical figures for Renault had been from 19,432 all the way down to 17,371. Stellantis’s three high-volume EV manufacturers in Europe (Peugeot, Fiat, and Citroen, mixed) collectively went from 39,999 all the way down to 37,328.

Thus, total European BEV volumes (and market share) are literally shrinking, and that is particularly seen in medium and enormous markets like Sweden and Germany.

Word that, if European legacy auto firms had been honest about shifting to BEVs, they might accomplish that, identical to many automobile firms in China are doing (China is now passing 50% plugin share as of June 2024). However these legacy auto firms will not be honest. Let’s repeat the unhappy reality — they’re as an alternative doing the minimal legally required, they’re overpricing their BEVs (even while EV-component prices are getting less expensive). They’re as an alternative making file earnings (paid out to traders and administration, not re-invested in EV analysis).

These of us European customers who need to make the swap to BEVs, even only a easy, reasonably priced, no-frills BEV, are flat out of luck. European quantity automakers don’t need to promote you an reasonably priced one, and China’s automakers are being restricted from promoting you an reasonably priced one.

The European EV state of affairs will briefly enhance in 2025 — solely as a result of barely tighter emissions necessities will resume in that 12 months, forcing the laggards to hurry up a bit — however the transition will thereafter stagnate once more till the following tightening.

Greatest Promoting BEV Fashions

Tesla, not a legacy automaker, once more had by far the perfect promoting BEV mannequin in July, the Tesla Mannequin Y, with 846 models delivered. That is up YoY from a extra modest 359 models in July 2023.

In second place was the Volkswagen ID.4 with 457 models, down from 710 models YoY. In third was the brand new Volvo EX30, shut behind with 446 models (after launching in December).

All the high 20 are acquainted faces, with few vital modifications in place.

When it comes to newly debuting fashions, there was just one in Sweden in July, the Xpeng G6, with 7 preliminary models. The Xpeng G6 is a mid-sized premium SUV coupe (4,753 mm) priced from SEK 540,000 (€46,650). It has 435 km of vary (WLTP cycle), very quick charging (21 minutes from 10% to 80%), and is aggressive on pricing in comparison with friends. Different variants, with longer vary and extra efficiency, are additionally obtainable. Let’s see the way it will get on.

Final month’s debutant, the brand new Audi Q6 e-tron, stepped up from its preliminary 3 models to a wholesome 66 models in July, and virtually entered the highest 20 in simply its second month available on the market. It’ll definitely be a comparatively common mannequin inside its section. Although, absolute volumes will clearly be constrained by its very excessive value level (SEK 899,000, €77,680).

Let’s now take a look at the long run rankings:

The Tesla Mannequin Y has over twice the amount of the runner up Volvo EX30. Although, there could also be some scope for the hole to slim barely, because the EX30 isn’t but demand constrained.

The Kia EV9 continues to climb slowly, now attaining the tenth spot, up from thirteenth. Scorching on its tail is the VW ID. Buzz, within the eleventh spot. Let’s see who wins this race as soon as the 7-seat model of the Buzz turns into extra obtainable within the coming months.

There are largely solely very minor shufflings within the high 12 spots. In thirteenth comes the Volkswagen ID.7, which launched again in November, up from thirty third within the prior three-month interval.

Outlook

The general auto market is down YoY by 6% 12 months thus far, with July in step with this development. The broader Swedish financial system can be comparatively weak, with Q2 figures exhibiting a 0.8% contraction of GDP 12 months on 12 months.

Inflation, nevertheless, diminished to 2.6% in June (newest) from 3.7% in Could. Rates of interest had been static at 3.75%. The manufacturing PMI for July fell again to 49.2 factors, from 53.0 factors in June, suggesting additional slowing forward.

I’ve mentioned above the primary influences on Sweden’s backtracking on the EV transition this 12 months. The central financial institution has signaled a possible discount of rates of interest someday within the autumn, which can give a slight bump to demand however not considerably change something. That must look forward to 2025 when legacy automakers need to promote extra BEVs to adjust to tighter rules, so don’t maintain your breath.

What are your ideas on Sweden’s EV transition and its quick and mid-term prospects? Please bounce into the dialogue beneath.