Join every day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

Plugin automobiles are all the fad within the Chinese language auto market, with plugins scoring a bit of greater than 1 million gross sales (in a 1.9-million-unit total market). That’s up 38% yr over yr (YoY), and the second greatest month ever, whereas the general market is down 1% YoY.

Wanting deeper on the numbers, progress mainly got here from the PHEV facet — BEVs had been up 19% in August, whereas PHEVs jumped 78% in the identical interval, to 442,000 items, which is a document month for the third straight time. Breaking down plugin gross sales by powertrain, BEVs had 57% of gross sales, or some 583,000 items, in keeping with the YTD numbers.

Contemplating the latest uptick in PHEVs, one should mirror on the rationale for such occasions. Are long-range plugin hybrids the silver bullet to chop via the mainstream market?

With BEVs getting greater than 1 / 4 of the full market, those shopping for PHEVs aren’t the early adopters — these have already joined the BEV bandwagon. Quite, they’re within the “early majority.” So, possibly PHEVs are certainly wanted to persuade that extra conservative a part of the inhabitants to go EV?

Anyway, again to gross sales. The year-to-date (YTD) tally is round 6.2 million items, a big rise over the 4.7 million items in the identical interval of 2023.

Share-wise, August noticed plugin automobiles hit a document 54% market share! Full electrics (BEVs) alone accounted for 31% of the nation’s auto gross sales. This pulled the 2024 share to 46% (26% BEV), and with the market with loads of room for progress, the yr ought to finish at round 50%.

Evaluating this consequence with what was occurring twelve months in the past, the 2023 plugin share was 35% (24% BEV), which signifies that, whereas BEVs are experiencing average progress (26% vs 24%), the PHEV share is rising quicker (20% vs 11%). At this tempo, we must always have the Chinese language market totally electrified round 2030.

The general prime six had been 100% plugins, with the Tesla Mannequin Y being the most effective promoting non-BYD mannequin, in third. The perfect promoting ICE mannequin was the Volkswagen Lavida, in seventh, with some 28,000 items bought. Highlighting the present shift in demand, there was just one ICE mannequin in August’s total prime 10, the VW Lavida, and that one is seeing its gross sales fall considerably. The German sedan dropped 16% YoY.

In August, out of the 9 plugin fashions within the total prime 10, six belong to BYD. The value cuts from the Shenzhen OEM are pressuring not solely the ICE competitors, which is perhaps kicked out of the highest 10 someday within the second half of the yr (September?), but in addition its plugin adversaries.

a number of measurement classes, all of the car segments have 100% PEV podiums apart from the C (compact) section, which is the one class the place ICE automobiles are nonetheless current. BYD’s Yuan Plus is representing the EV staff in that class, whereas the upcoming (not so) compact hatchback, the Seal 06 GT, will certainly assist issues for the EV facet.

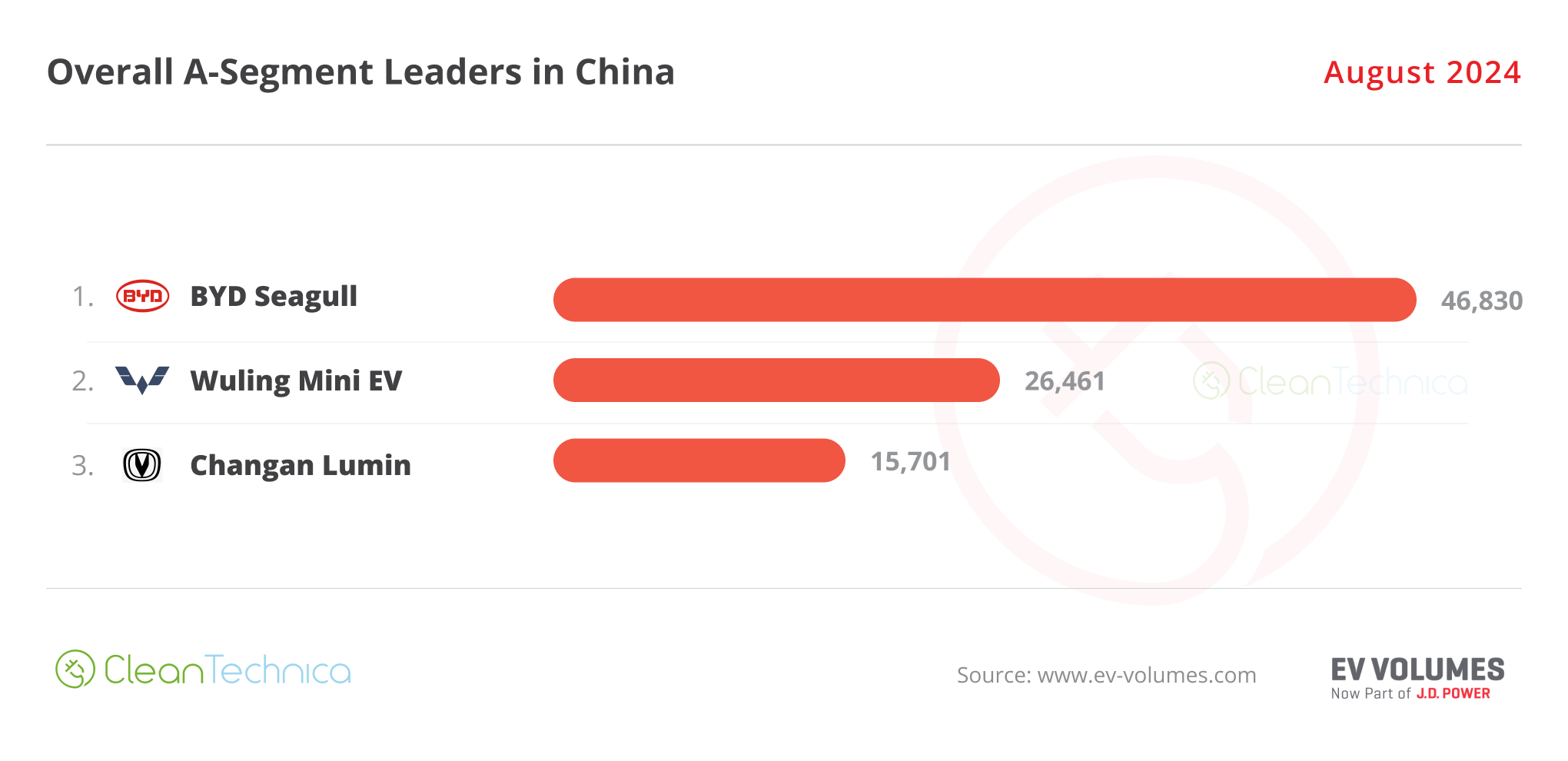

Amid BYD’s present market domination, it’s fascinating to see that the make is focusing extra on the D section/midsize class, and dropping its grip on different classes, at the moment main in simply two car classes, the aforementioned midzise class and the A section/metropolis automobile class.

In subcompacts (B section), the Wuling Bingo is benefiting from cut up gross sales within the BYD discipline — between the established Dolphin (15,984 items) and the rising Yuan Up (19,344 items). Within the full measurement class, the just lately launched AITO M9 is thrashing the earlier chief, the BYD Han, by over 1,000 items. Not dangerous for a XXL luxurious SUV that begins at $66,000…. We must always have a detailed race between these two within the following months. The shock is Xiaomi putting its SU7 celebrity within the third place. That signifies that this class is 100% plugin — and it’s additionally a 100% home podium. So, that is one other class that legacy OEMs can say bye bye to.

Finest Promoting EVs — One by One

Concerning final month’s greatest sellers desk, the highest 5 greatest promoting fashions within the total desk precisely mirrored those within the EV desk — which as soon as once more proves the merging course of that we’re witnessing between the 2 tables. Right here’s extra information and commentary on August’s prime promoting electrical fashions:

#1 — BYD Track (BEV+PHEV)

BYD’s midsize SUV is the uncontested chief within the Chinese language automotive market, and the Track retained the management place in August, retaining its rival, the Tesla Mannequin Y, at a long way. The midsize SUV scored 59,087 registrations, with the excellent news being that 15,032 items belonged to the BEV model (greater than regular). Will the Track proceed to rule within the Chinese language automotive market? It’s going to depend upon the competitors, particularly the inner competitors. Within the close to future, the Track should compete in opposition to powerful inside competitors, just like the just lately launched Track L and Sea Lion 07 in addition to the premium car-on-stilts Denza N7 (a automobile that sits someplace between the Tesla Mannequin Y and the Zeekr 001). All of those fashions desire a piece of the pie. That is in all probability an excessive amount of competitors inside BYD’s midsize SUV portfolio for the Track to proceed clocking 50,000 gross sales/month, a obligatory threshold to proceed main the cutthroat Chinese language auto market. However because of its aggressive pricing, the Track is continuous its success story.

#2 — BYD Seagull

Issues proceed to go effectively for the hatchback mannequin, with the small EV leaping into the second spot because of a document 46,830 registrations. With a part of manufacturing now being diverted to export markets, it appears demand for the little Lambo continues to be rising in China. And with larger export potential than the common Track, the perky EV might change into the greatest promoting BYD globally quickly. With its consideration now diverted to different geographies, like Latin America and Asia-Pacific (and Europe?), we might see the little hatchback ascend to the second place within the EV rating in 2025, each globally and at dwelling.

#3 — Tesla Mannequin Y

Tesla’s star mannequin bought 45,330 registrations, down 11% YoY. That allowed it to land in third within the total rating. Regardless of the gross sales drop, it was month for the US crossover, because it was its greatest month up to now this yr. The Mannequin Y retains Tesla related within the Chinese language market — no small feat contemplating present market developments (the Tesla Mannequin Y, along with its sibling Tesla Mannequin 3, had been the one overseas fashions in August’s prime 20). Wanting into the longer term, it is going to be fascinating to see how each fashions will probably be affected (or not) by two upcoming self-declared anti-Tesla fashions, the NIO’s Onvo L60 and Xpeng’s Mona M03.

#4 — BYD Qin Plus (BEV+PHEV)

Together with the Track, the BYD Qin has been a bread and butter mannequin for the Chinese language automaker for a very long time. The midsize sedan reached 42,765 registrations in August (a document 26,093 items belonged to the BEV model). This allowed it to be fourth within the total market. Costs begin at 80,000 CNY ($12,000), and demand nonetheless appears excessive. Regardless of the robust inside competitors — simply take a look at the brand new, fancier Qin L in fifth and the Seal 06 in sixth — the unique midsize sedan from BYD is compensating for the loss in demand on the PHEV facet (to the aforementioned two newer fashions) with a rise in gross sales on the BEV facet, the place for the time being it doesn’t undergo from robust inside competitors. Anticipate the decrease priced sedan to proceed posting robust outcomes at the price of the competitors, EV or ICE, all whereas retaining its exterior direct rivals — the Tesla Mannequin 3, Wuling Starlight, and GAC Aion S — at a secure distance.

#5 — BYD Qin L

This new sedan is mainly the third era of the BYD Qin, however as a result of the second era continues to be working robust, BYD added the suffix “L” to the brand new one to separate the 2. In any case, it has landed with a bang, leaping into the highest 5 in solely its second full month in the marketplace! In August, it repeated the feat, staying in fifth with a document 35,957 gross sales. And it has executed this with out hurting the gross sales of the common Qin Plus an excessive amount of. At this second, BYD has a kind of Midas contact, reworking into gold (virtually) all the pieces it launches in the marketplace, and it has launched quite a bit of steel just lately…. Simply to present an thought, if we had been so as to add the July gross sales of the Qin Plus with the gross sales of the Qin L and the gross sales of the #6 Seal 06 (which is a kind of left-field trim line of the Qin L) and the #11 Destroyer 05 (the left-field trim line of the Qin Plus), we might get greater than 133,000 registrations! That’s greater than what the Tesla Mannequin Y does globally….

BYD’s Domination within the Prime 20

the remainder of the highest 10 checklist, there have been six BYDs in complete within the prime 7 positions. And that’s not all….

… the remainder of the desk, we have now 5 extra BYDs, with the Destroyer 05 in #11, the Yuan Up in #12, the Track L in #14, the Dolphin in #16, and the Han in #19. There have been thus eleven BYD representatives within the prime 20. Amazingly, six of these eleven fashions all sit within the midsize class….

It looks like, to beat the Dragon Kings (Tesla Mannequin Y/3), BYD raised a pack of smaller Dragons, which on their very own won’t be sufficient to beat the Kings, however when preventing collectively, they certain can depart them within the mud. (E Pluribus Unum and all that.…)

This type of domination is going on at a time when BYD has a number of potential greatest promoting fashions both ramping up (the Qin L, Seal 06, Yuan Up, and Track L all had document months) or touchdown. At this level, these fashions will probably cannibalize present BYD fashions, however they’ll probably additionally steal gross sales from the competitors.

One does begin to surprise at what level BYD’s new-model-launch fever will begin to get counterproductive…. How a lot is an excessive amount of?

Extra Prime 20 Notes

Exterior the BYD Galaxy, the massive shock is the tiny Wuling Mini EV, which jumped into eighth with 26,461 items, the EV’s greatest consequence since February 2023. Highlighting Wuling’s good month, the larger Bingo additionally had a year-best consequence, 22,185 gross sales.

The Tesla Mannequin 3 ended the month in #13, with 18,126 gross sales, which is a 34% enhance in comparison with the sedan’s efficiency a yr in the past. Are Chinese language consumers lastly warming as much as the refreshed Tesla?

One other mannequin on the rise is the AITO M9, which was in fifteenth with a close to document 16,955 deliveries, 1,188 of them belonging to the BEV model. The flagship AITO is the make’s latest mannequin, and doubtless the most effective from the make up to now. Anticipate the 5.2-meter (205-inch) land yacht to change into a frequent presence within the desk and a severe contender for the XXL SUV class title.

Chip in just a few {dollars} a month to assist assist impartial cleantech protection that helps to speed up the cleantech revolution!

Exterior the highest 20, as regular, there was quite a bit to speak about, like Chery’s Fengyun T9 PHEV crossover, which delivered 8,856 gross sales in August, a powerful consequence for a mannequin that’s solely in its 4th month in the marketplace.

Geely noticed its new Galaxy E5 crossover attain a powerful 12,227 items in its first full month, among the finest landings ever, so the E5 could possibly be the lengthy awaited star participant from the Geely conglomerate. It might have the ability to not solely safe a desk presence, but in addition beat the class’s BYD competitors. Nonetheless speaking Geely, the Panda Mini registered 11,122 items, a brand new yr greatest for the town automobile.

On the startup discipline, the spotlight was the Leap Motor’s C16 full measurement SUV, which hit a document 8,032 gross sales, whereas its smaller siblings, the midsize C11 (6,878 gross sales) and the compact C10 (6,554 gross sales) additionally posted constructive numbers, which signifies that the Hangzhou startup is at the moment probably the most promising EV corporations in China.

overseas OEMs, the one spotlight comes from the Volkswagen ID.3, which had a year-best rating of 9,468 gross sales.

The 20 Finest Promoting Electrical Autos in China — January–August 2024

Wanting on the 2024 rating, there’s nothing new within the prime positions, with the rostrum bearers BYD Track, BYD Qin Plus, and Tesla Mannequin Y safely of their positions.

We’ve got to go right down to the sixteenth place to see some motion. The rising Li Xiang L6 has jumped three positions and is now sixteenth, with the midsize SUV probably leaping extra spots in September, in all probability ending that month in thirteenth and ending the yr within the prime half of the desk.

One place down, we have now the brand new BYD Qin L, which simply joined the desk, in #17, and also will bounce a number of positions within the coming few months, probably ending the yr inside the highest 10.

Modifications within the Total Model Rating

In August, the highest three positions mirrored the 2023 full yr rating, with BYD on prime adopted by Volkswagen and Toyota. The dynamics are fairly totally different, although. BYD (358,000 gross sales) grew 56% YoY, doubling the gross sales of #2 Volkswagen (171,000 gross sales), which was down by 12%, and #3 Toyota (135,000 gross sales), which fell by 13%. So, whereas the primary place automaker continues to be rising quick (to infinity and past?), the opposite two are dropping vital floor in a quick altering market.

Honda, 4th within the full yr of 2023, was solely ninth in August, with a steep gross sales drop of 44% YoY. It’s like the bottom is vanishing from beneath the Japanese carmaker.

Nonetheless, there are others worse than Honda, like Buick, which was down 60% in August; Cadillac, which dropped by 59%; and Chevrolet, which did even worse, cratering a worrying 84%! Mainly, it seems to be like GM is being worn out of China….

So, with these steep drops in gross sales occurring, it gained’t take lengthy till sure legacy OEM associated factories are shut down.

Wanting on the prime 10 as complete, there may be additionally an fascinating dynamic — all 5 overseas OEMs current there have seen their gross sales drop, whereas on the home facet, solely Changan has seen its gross sales drop. And even within the case of Changan, there may be a proof: the Changan model is being left with the ICE enterprise and outdated EV fashions, whereas the newer stuff is being despatched into the extra premium Deepal model and the brand new Qyiuan model, each NEV-only manufacturers.

The numbers don’t lie — overseas makes are dropping market share by the day in China, to the revenue of the home ones. This can be a seismic shift that guarantees to broaden past Chinese language borders in coming years.

Auto Manufacturers Promoting the Most Electrical Autos in China

Wanting on the auto model rating, there’s no main information. BYD (32.3%, up 0.9% from July) is agency in its management place, and there’s actually no strategy to see this domination ending anytime quickly.

Issues get extra fascinating beneath, although. Tesla (6.4%, down from 6.5%) is comfy within the runner-up spot, whereas Wuling profited from good outcomes from its dynamic duo (Bingo and Mini EV) to extend its share (5.1% in August vs 4.6% in July) and surpass Li Auto (4.7%), which is benefitting from the recognition of its new L6 mannequin to maintain its standing as probably the most profitable startup.

Geely noticed its Galaxy E5 & Panda Mini siblings shine, and has seen its share climb 0.2%, to 4.2% in August, permitting it to surpass AITO (4.1%, down from 4.4%) and attain the fifth place.

Aion (3.7%) is seventh, however with out contemporary greatest sellers coming in, don’t count on it to affix the race for fifth.

Auto Teams Promoting the Most Electrical Autos in China

OEMs/automotive teams/auto alliances, BYD Group is comfortably main, with 34% share of the market. That enhance in share is generally because of the robust outcomes of the namesake model, as its daughter manufacturers counted collectively really misplaced share (0.3%, to be extra exact). So, whereas the primary model goes from power to power, Denza, Fang Cheng Bao, and Yangwang will not be doing their half in the case of growing the OEM’s revenue margins. Hey, one can’t have all the pieces, proper?

At this second, it appears BYD has its home market domination effectively assured, replicating what Tesla is doing within the USA.

Geely–Volvo is a distant runner-up, with 7.8% share, with the namesake’s good lead to August being dragged down by sister manufacturers having a sluggish month (ahem, Zeekr, ahem).

Tesla (6.4%) is agency in third, whereas #4 SAIC (6.2%) hasn’t profited from Wuling’s good outcomes, as a consequence of weak outcomes elsewhere.

Shanghai Auto’s (SAIC’s) place within the Chinese language market seems to be fragile, as a result of aside from Wuling, the remaining manufacturers are scattered in crimson, together with their JV overseas companions, GM and VW. For instance, in August, MG dropped 22% and Maxus was down by 18%, simply to call the 2 greatest recognized manufacturers from the OEM. True, its new premium model, IM Motors, jumped by 239% YoY, however with simply 6,100 items bought in August, it barely moved the needle. Whereas SAIC is a type of too large to fail corporations, one thing must be executed with it.

Again to the OEM desk, #5 Changan misplaced share (now at 5.8%, down from 6.2% in July), however with #6 GAC (4.7%) nonetheless far behind, don’t count on the Chongqing-based firm to really feel threatened for now.